When it comes to cryptocurrency, two of the most popular options are Litecoin (LTC) and Ethereum (ETH). Both have been around for a few years now and have experienced incredible growth in user adoption and price appreciation.

As such, both cryptocurrencies have generated a lot of buzz and attention from investors, traders, miners, developers, and more.

In this guide, we’ll break down the differences and similarities between Litecoin and Ethereum so that you can make an informed decision about which cryptocurrency is right for you.

ARE LITECOIN AND ETHEREUM THE SAME?

No. Litecoin and Ethereum are two different cryptocurrencies. They differ in terms of functionality, purpose, technology, and development. Each coin has its own strengths and weaknesses, so it’s important to understand the differences before you decide which one is right for you.

Our top rated Ethereum casinos

Our top rated Tron casinos

Our top rated EOS casinos

WHAT IS LITECOIN?

Litecoin is a payment-focused cryptocurrency designed to be a fast and secure form of digital cash. It uses the Scrypt proof-of-work algorithm to validate transactions on its blockchain network, which enables it to provide faster payment processing times compared to Bitcoin.

Additionally, Litecoin offers greater privacy than other cryptocurrencies due to its use of advanced encryption technologies.

Introduced in 2011, Litecoin has become one of the most widely adopted cryptocurrencies, with a variety of merchants and services now accepting it for payments. As a fork of Bitcoin, Litecoin shares a lot of the same features but with some notable differences.

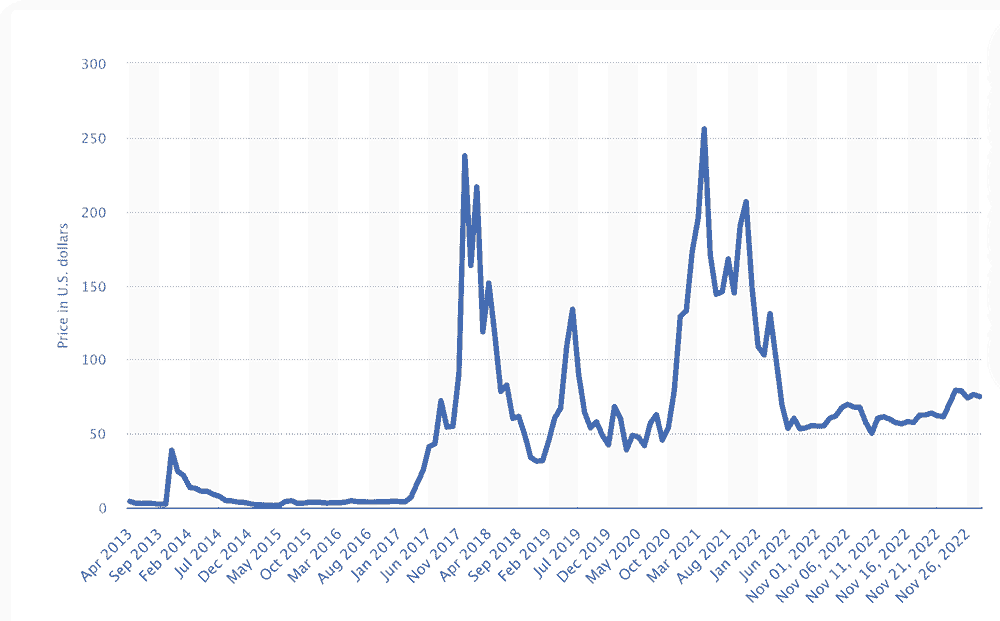

LITECOIN PRICE CHART

For example, Litecoin is able to process transactions faster than Bitcoin, with a maximum block time of 2.5 minutes compared to 10 minutes for Bitcoin. This makes it attractive for merchants who want to accept payments quickly and securely.

HOW DOES LTC WORK?

Like other cryptocurrencies, Litecoin relies on a decentralized network of computers to validate and secure transactions. This is done via the Scrypt proof-of-work algorithm mentioned above, which is designed to be more energy efficient than Bitcoin’s SHA256 hashing algorithm.

The Litecoin network also uses Segregated Witness (SegWit) technology to increase speed, reduce transaction fees, and provide additional features such as atomic swaps, which allow users to trade cryptocurrencies without an intermediary.

WHAT IS ETHEREUM

Ethereum is a decentralized blockchain platform that enables developers to create and deploy distributed applications (DApps).

Unlike Litecoin, which is focused on managing payments, Ethereum is focused on providing an open platform for developers to build blockchain-based applications. When Ethereum first launched, it also used the proof-of-work consensus algorithm to validate transactions.

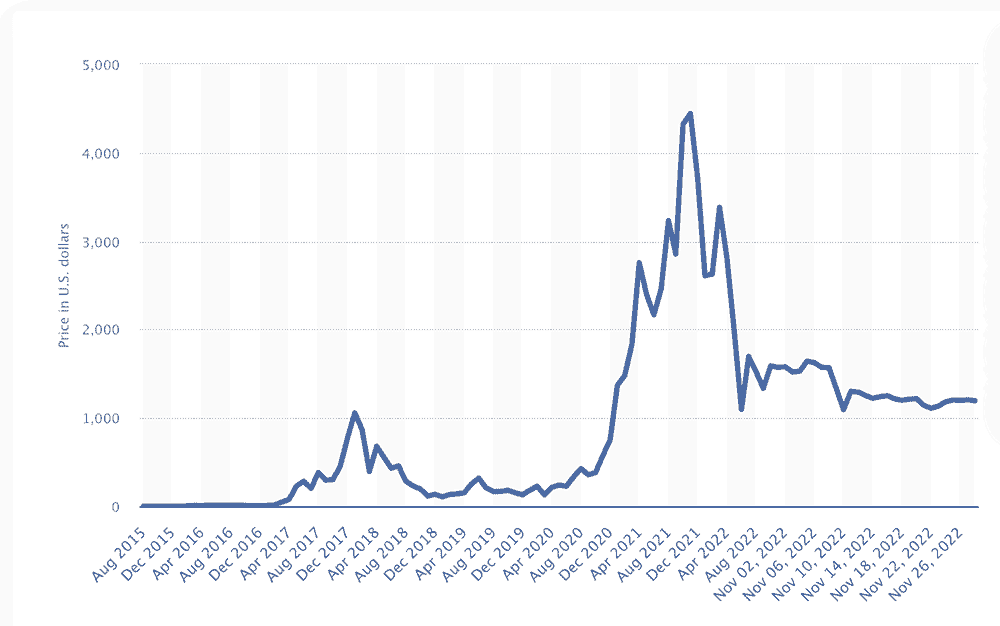

ETH PRICE CHART

While similar, it used a different set of features and capabilities than Litecoin. Ethereum continued to use its proof-of-work algorithm until 2023 when it switched over to a proof-of-stake consensus algorithm.

Launched in 2015, Ethereum has quickly become one of the most popular cryptocurrencies for DApp development. It is also used by a variety of companies for crowdfunding and other purposes.

HOW DOES ETH WORK?

Unlike Litecoin, Ethereum is not just a digital currency but also a decentralized platform for creating applications. This platform is powered by its own cryptocurrency, Ether (ETH), which is used to pay developers for the applications they create.

Ethereum allows developers to build smart contracts and decentralized autonomous organizations (DAOs) that are stored on the Ethereum blockchain and powered by the Ether token.

Important: Smart contracts are essentially self-executing programs that run automatically once predetermined conditions have been met, while DAOs are decentralized organizations that operate independently of any individual or group.

As stated, the Ethereum network today is secured via a proof-of-stake (POS) algorithm, which requires users to stake their ETH tokens in order to validate transactions and earn rewards.

This is a more energy-efficient approach than the proof-of-work (POW) algorithm used by Bitcoin, which requires miners to solve complex mathematical equations in order to confirm and secure transactions.

LITECOIN VS ETHEREUM: EXPLORING THE KEY DIFFERENCES

As two of the most popular virtual coins, Litecoin and Ethereum share a lot of similarities. However, there are just as many differences between them, as well. For example:

- Creation: Litecoin was created to improve upon Bitcoin, while Ethereum is a completely different platform with its own blockchain. Where the two coins do differ is in their approach to the technology behind them.

Litecoin strives to heavily improve on Bitcoin’s blockchain, such as faster transactions, lower fees, and improved scalability.

Ethereum, on the other hand, focuses on smart contracts, allowing applications to be built on top of its blockchain. Smart contracts are used for a variety of applications, including the trading of digital assets. - Value: The value and price of Litecoin are closely tied to Bitcoin, as it is seen by many as the silver to Bitcoin’s gold. Ethereum also follows a similar pattern but differs in its use case, making it less dependent on Bitcoin’s influence.

The price of both coins does tend to fluctuate wildly due to market volatility, so investors should be prepared to handle the risks associated with such fluctuations. At the time of this writing, Litecoin is valued at $73.84, while Ethereum is valued at $1,171.75. - Growth: Litecoin has grown steadily since its launch and has enjoyed a consistent rate of growth. It is now the thirteenth-largest cryptocurrency by market capitalization, making it one of the most successful coins in the crypto market space.

Ethereum has seen even more rapid growth, as its platform and technology have garnered much attention from entrepreneurs and investors alike.

Its current market capitalization is the second-largest in the cryptocurrency space. Only Bitcoin has a larger market cap than Ethereum at present. - How It Works: Litecoin and Ethereum are both decentralized, peer-to-peer networks that allow users to send and receive payments securely and anonymously. Litecoin is focused on becoming a global payment solution, while Ethereum is designed as an open platform for developers to build applications on top of.

Both cryptocurrencies use blockchain technology designed to record transactions permanently in a distributed ledger. Litecoin’s blockchain is secured by mining, in which miners verify transactions and add them to the public ledger.

Ethereum uses a process called “proof-of-stake” to validate transactions, where miners must own a certain amount of the cryptocurrency in order to mine. - Purpose: The primary purpose of Litecoin is to act as a more efficient form of digital money than Bitcoin. It has also been used for its faster block times, allowing it to offer near-instant transactions.

Ethereum, on the other hand, is primarily used as a platform to build and run decentralized applications. These DApps are powered by smart contracts, which are self-executing computer programs that run off the Ethereum blockchain.

What this means is that both cryptocurrencies have different purposes and target users of different types. - Mining: The two cryptocurrencies have different mining processes, as well. Litecoin is based on the same proof-of-work algorithm as Bitcoin, which is the Scrypt algorithm previously mentioned.

Ethereum has its own algorithm called Ethash. This is the proof-of-stake algorithm talked about above, which is designed to be more energy-efficient than proof-of-work algorithms.

While Litecoin miners must process a hash algorithm in order to mine the currency, Ethereum miners must stake their Ether tokens in order to validate transactions on the network. - Transaction Speed: When it comes to speed, Litecoin is the clear winner. It can handle 54 transactions a second. Compare this to Ethereum’s 15 to 20 transactions per second.

This makes Litecoin more attractive for payments and money transfers. Ethereum’s slower transaction speed has long been a pain point for users.

Whereas cryptocurrencies like Litecoin have become increasingly popular for payments, Ethereum is more suitable for use cases that don’t require speed, such as creating smart contracts. So there are definitely some pros and cons to each. - Transaction Fees: Cryptocurrencies charge fees for transactions, and both Litecoin and Ethereum have their own fees. Litecoin has significantly lower transaction fees than those of Bitcoin, making it a cheaper option for users.

Ethereum’s transaction fees can be higher or lower depending on the complexity of the operation being performed.

On average, Litecoin’s fees are around 0.007 LTC, while Ethereum’s can range anywhere from a few cents up to tens of dollars. - Block Time: Block time is the amount of time it takes for a new block to be added to a blockchain network. Litecoin’s average block time is 2.5 minutes, while Ethereum’s is 10 to 20 seconds.

This means that transactions on the Litecoin network take slightly longer to confirm than those on the Ethereum network, but they are still much faster than those on the Bitcoin network. - Supply: Another key difference between Litecoin and Ethereum is their supply. The maximum amount of Litecoins that can be mined is 84 million, compared to Ethereum’s unlimited supply. This means that while Litecoin is a deflationary currency, Ethereum is an inflationary one.

Therefore, those looking to hold either cryptocurrency as an investment will want to keep this in mind when making their choice. - Smart Contracts: The last notable difference between Litecoin and Ethereum is that Ethereum supports smart contracts, which are self-executing computer programs. These contracts can be used to store data, execute escrow agreements, or manage many other types of digital services.

Litecoin does not support smart contracts, and this makes it a less attractive option for users who require advanced features.

Comparison Table for Ethereum and Litecoin

Create a table to compare two coins side by side

| Difference | Ethereum | Litecoin |

| Price | $1,171.75. | $73.84 |

| Block Time | ~15 seconds | 2.5 minutes |

| Maximum Supply | Unlimited | 84 million |

| Supply in Circulation | 120.5 million | 71.7 million |

| Market Capitalization | #2 ($146 billion) | #13 ($5.2 billion) |

| Transaction Speed | 15 to 20 per second | 54 per second |

ETHEREUM COIN: PROS AND CONS

Although Ethereum is the second-largest cryptocurrency by market capitalization, it has its share of pros and cons. Review these below to help you determine if Ethereum is right for you.

- Ethereum is a versatile platform that can be used for much more than just financial transactions. It has the capability to serve as a decentralized computing platform for applications such as smart contracts and DApps.

- Ether, the native token of the Ethereum network, is a key factor in this versatility. Developers can use Ether to pay for transaction fees and services on the network.

- Ethereum blockchain is more secure and faster than other blockchains because it implements a proof-of-stake consensus mechanism, which makes it easier for miners to reach an agreement on the network more efficiently.

- Ethereum can be difficult to understand and use, and its complexity can turn people away.

- Ethereum’s transaction fees can be higher than other blockchains because of the increased demand on the network.

- Ethereum is still a relatively young blockchain and has yet to prove itself as an established platform for trustless transactions. As such, it has not yet gained the complete trust of the crypto community.

- Ethereum is susceptible to scalability issues, meaning that it can take a long time for certain transactions to be processed. This can be a problem during periods of high demand on the network.

LITECOIN: PROS AND CONS

Litecoin’s unique features have attracted many crypto enthusiasts, but it also has its share of drawbacks. Consider these pros and cons before investing in Litecoin.

- Litecoin has much faster transaction times than Bitcoin, allowing users to send and receive funds almost instantly.

- Because of its higher transaction speed, users incur lower fees when using Litecoin compared to other cryptocurrencies.

- The Litecoin network is secured by the Scrypt proof-of-work algorithm, which makes it more resistant to attacks by miners with specialized hardware.

- Litecoin also has a larger total supply than Bitcoin, which makes it more accessible to those looking to invest in cryptocurrency.

- Litecoin does not have the same level of adoption as Bitcoin and other major cryptocurrencies, making it harder for users to find places to spend it.

- Litecoin also does not have a large development community behind it, which could lead to potential delays in updates and features.

- Litecoin’s value is highly correlated with Bitcoin’s price, meaning that it can suffer from sudden swings if the market moves against it.

- The Litecoin network is not as secure as other blockchains because it does not implement a proof-of-stake consensus mechanism. This means that miners can easily gain control of the network if they are able to amass enough computing power.

- Finally, Litecoin’s price can be highly volatile, making it a risky investment for those who are not willing to take on high levels of risk.

WHAT MAKES ETHEREUM AND LITECOIN SIMILAR?

Both Ethereum and Litecoin are two of the most popular cryptocurrencies existing today. On a fundamental level, they are both open-source projects that are powered by blockchain technology, enabling decentralized and trustless transactions.

This means that no central authority is needed to facilitate and confirm each transaction, greatly reducing the risk of fraud or censorship.

The coins themselves are also interchangeable, meaning that users can send and receive coins on either platform. Both Litecoin and Ethereum feature advanced scripting capabilities for smart contracts, allowing developers to create custom agreements or applications that are secured by blockchain technology.

Lastly, both networks use mining as a way to secure their blockchains and reward miners for contributing computing power.

IS IT BETTER TO BUY ETHEREUM OR LITECOIN TODAY? OR BOTH?

The question of whether to buy Ethereum or Litecoin is a difficult one. Both digital currencies offer advantages and drawbacks, as outlined above. So it’s important to carefully consider the unique features of each before deciding which one (or both) are best for you.

If you have the finances to spare, the best choice may be to buy both Ethereum and Litecoin. This allows you to diversify your investments and benefit from both coins’ strengths. If you have to choose between the two, then it comes down to your finances and personal preferences.

Litecoin is a good choice for those who want a digital currency that is fast, affordable, and backed by reliable security. Ethereum, on the other hand, is better for those looking to take advantage of its smart contracts and decentralized applications capabilities.

ETHEREUM VS LITECOIN: WHAT IS BETTER AT THE END?

When it comes to comparing Ethereum vs Litecoin, both coins have strong points in their favor. Ethereum is a well-established platform with numerous applications and a large user base.

Litecoin has lower fees and faster transaction times than Ethereum, and it’s an attractive choice for those who need an affordable cryptocurrency to invest in.

However, Litecoin has gradually declined in its standing over the years, while Ethereum has continued to rise in value and popularity. So if you want to make an investment that has the potential to have a strong return, Ethereum is likely your best option.

Key Takeaways

- Ethereum has a market cap of around $146 billion compared to Litecoin’s market cap of around $5.2 billion.

- Litecoin can be bought on many cryptocurrency exchanges and other platforms such as Coinbase, Binance, and Gemini.

- You can buy Ethereum from a variety of exchanges, including Coinbase, Bitstamp, and Kraken.

- Litecoin is designed to have faster transaction times, better scalability, and increased storage capacity than Ethereum.

- Litecoin has lower fees and faster transaction times than Ethereum, and it’s an attractive choice for those who need an affordable cryptocurrency to invest in.